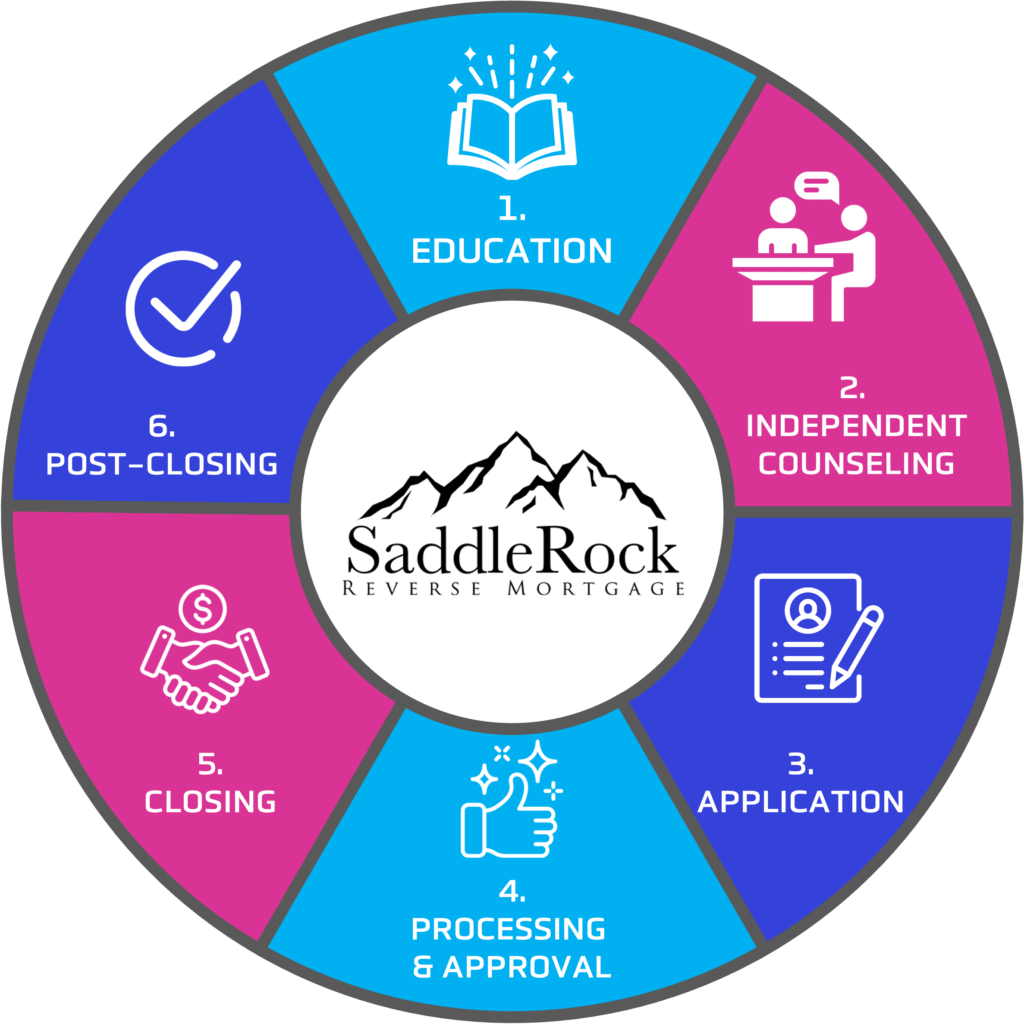

The SaddleRock Process

The reverse mortgage process explained

The entire reverse mortgage application process typically takes a total of about 30-45 days right from the day that the processing starts and it has six steps.

EDUCATION

We begin the process by educating…not selling.

We personally meet with you, and any family members you choose, to assess your individual needs and financial situation. This includes reviewing your income, assets, and expenses; talking with you about your particular plans and concerns, and estimating how much money you may qualify for.

We thoroughly explain the eligibility factors, benefits, features, options, costs, and borrower obligations associated with reverse mortgage products.

We answer all your questions and help you determine if a reverse mortgage is the right solution for you— and if so, which type best fits your needs and goals. We then prepare you for your reverse mortgage counseling session if you choose to move forward.

INDEPENDENT COUNSELING

To ensure that you understand all aspects of a reverse mortgage, you are required to have a counseling session with an independent counselor who is approved by the U.S. Department of Housing and Urban Development (HUD).

The borrower is given a list of counselors in the preliminary Reverse Mortgage package that is given to them when the loan consultant meets them for the first time. The borrower then can choose any counselor on the list and they then call and make an appointment for the counseling. It usually takes about 60 to 90 minutes and can be done in-person or over the phone.

After completion of the counseling session, the borrower will be sent the certificates proving that they attended and passed the counseling session. Once those certificates are received, the loan consultant can take the application, but the appraisal cannot be ordered until a 7-day “cooling off” period has occurred.

APPLICATION

If you decide to proceed with the loan, we will help you complete the application and collect your documentation. We will meet with you at your home or a place convenient for you.

Some of the required documents include: your signed counseling certificate, photo identification, verification of Social Security number, recent property tax bill, proof of homeowner’s insurance, and existing mortgage bill (if applicable). In addition to these, we will obtain income and asset information as required for the process. We will let you know exactly which documents you’ll need to provide.

Our face-to-face application process will allow you to ask all the questions you might have. In addition, if you wish to have family members present, we welcome you to do so. Once the application is complete, we submit the application for processing and approval.

PROCESSING & APPROVAL

We will submit the paperwork and process your application. Processing of your loan is completing a file for submission to an underwriter for approval. This is a combination of compiling the information and documentation you have provided us as well as ordering outside documentation.

A home appraisal, which determines the exact value of your home, will be ordered.

We will open escrow and title.

We will also order title work and existing mortgage payoff amounts.

We will compile asset, income, and credit information.

An underwriter will then review the application for approval.